Task Automation

Automate your goodbye letters, NOI, and more!

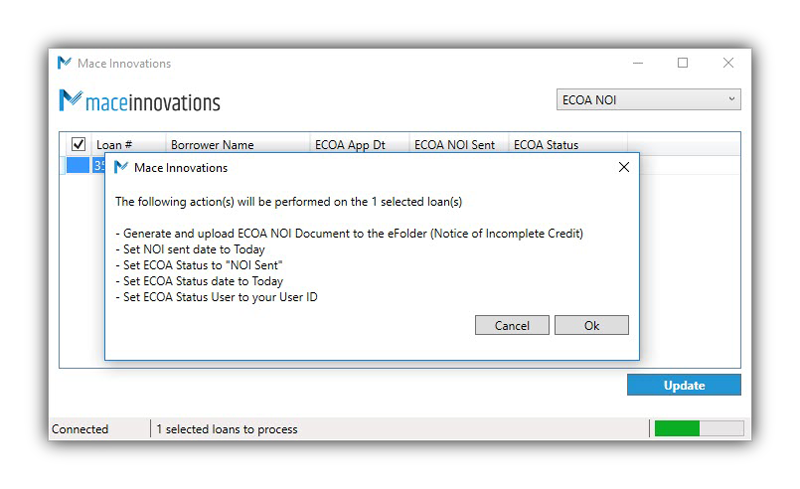

Accomplish high levels of automation on processes that take hours. To get started:

- Create a pipeline view

- Tell us which actions to perform

- We automate the entire process

- Once automated, you only have to click a button to watch hours of work performed in minutes!

LESS TIME

0

%

Task Automation eliminates up to 95% of the time required to complete tasks.

Why spend hours repeatedly performing the same functions when you can instead click one button?

Accelerate Productivity

Update hundreds of loans with one click and print one bundle of notices.

Address regulatory compliance with confidence

Data driven automation ensures files don’t slip through the cracks and improves your loan data.

Deliver a positive compliance experience

Originators can provide necessary information on their schedule while maintaining compliant timeline requirements.

Time is money